Providing algorithmic execution service and analytic service to streamline your trading needs |

| Products & Services |

| Data Products |

Internal Data

Internal Data

External Data

External Data

|

| Infrastructure Products |

Algorithmic Trading Engine

Algorithmic Trading Engine

Volatility Benchmarking Tools

Volatility Benchmarking Tools

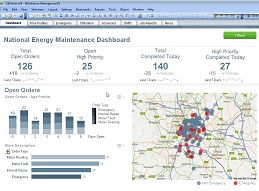

Big Data Business Intelligence

Big Data Business Intelligence

High Performance CEP

High Performance CEP

|

| Research Products |

Volatility Research

Volatility Research

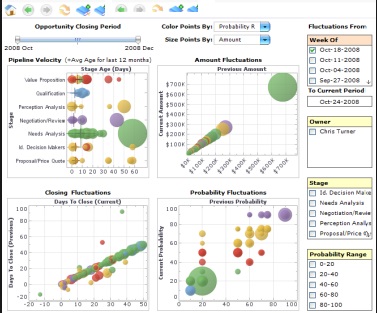

Basket/Pair Trading Analytic

Basket/Pair Trading Analytic

Indices/ETF Tracking Analytic

Indices/ETF Tracking Analytic

|

| Analytic Services |

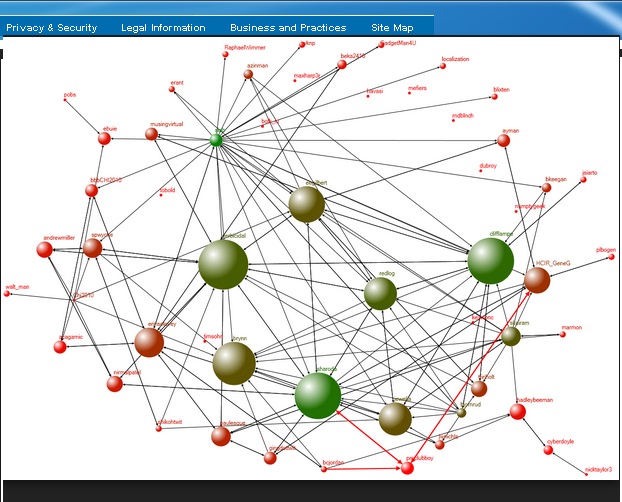

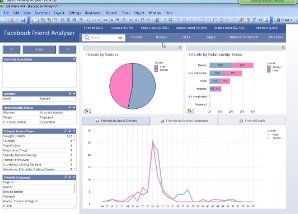

Customer Analytic

Customer Analytic

Marketing Analytic

Marketing Analytic

Pricing Analytic

Pricing Analytic

News Analytic

News Analytic

Survey Analytic

Survey Analytic

Credit Rating Analytic

Credit Rating Analytic

|

| Products > Big Data Business Intelligence | ||||||||||||||

|

Big Data Business Intelligence |

||||||||||||||

|

Making Investment Insight Relevant by Big Data

Key Advantages

|

| Our Capabilities |

Consulting Services Consulting Services

Risksis provides state-of-the-art analytic and consulting services for individuals and institutions |

Contact Us Now! Contact Us Now!

We are happy to give you a free demo and first-time technical consultation. |